Electricity expenditure is more than Rs.2 lakh on foreign travel whether for yourself or any other person or 2 lakh on foreign travel: You have to mandatorily file a tax return if you have incurred a total expenditure of more than Rs. 50 lakh or more in one or more of your savings bank account. 50 lakh in 'savings' bank account: You have to mandatorily file a tax return if you have deposited a total amount of Rs. However, no such requirement has been specified for deposits made in with post office current accounts or 1 crore or more in one or more current accounts with a bank. 1 crore in 'current' bank account: You have to mandatorily file a tax return if you have deposited a total of Rs. If you have loss from business/profession or under capital gains head, you will not be allowed to carry them forward to the next years unless you file the return before the due date.Īlso, you are mandatorily required to file ITR even if your income is below the basic exemption limit but you meet one of these conditions: If the taxpayer is a company or a firm, irrespective of profit or loss.Ħ. If you wish to apply for a visa or a loanĥ. If you have earned from or have invested in foreign assets during the FY.Ĥ. If you want to claim an income tax refund from the department.ģ. If your gross annual income is more than the basic exemption limit as specified below- Particularsįor individuals above 60 years but below 80 yearsĢ.

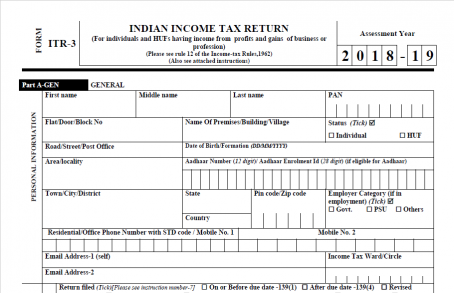

It is mandatory to file income tax returns (ITR) in India if any of the conditions mentioned below are applicable to you:ġ. The applicability of ITR forms varies depending on the sources of income of the taxpayer, the amount of the income earned and the category of the taxpayer like individuals, HUF, company, etc. Every taxpayer should file his ITR on or before the specified due date. The department has notified 7 various forms i.e. Income Tax Return (ITR) is a form in which the taxpayers file information about their income earned and tax applicable, to the income tax department. This article gives an in-depth understanding of the ITR definition and types of ITR forms. The Income Tax Act, 1961 releases all the ITR forms and specifies the procedures to be followed.

0 kommentar(er)

0 kommentar(er)